Taxation Of Individuals And Business Entities 2025 Pdf24 – For 2025, the estate and gift tax exemption is $13,610,000 per person. That means any one person can give during their lifetime or at their death a total of $13,610,000 without incurring gift or . How you set up your business can have major consequences, from how easy it is to operate on a day-to-day basis to how you pay your taxes. It can also determine whether you are personally liable if .

Taxation Of Individuals And Business Entities 2025 Pdf24

Source : www.linkedin.comScott Verschoor on X: “Read @kpmgus_tax report that analyzes

Source : twitter.comLaches | March 2025 by Hour Media Issuu

Source : issuu.comLizzy Lozano, Author at UPDF

Source : updf.comLaches | March 2025 by Hour Media Issuu

Source : issuu.comHow to get admission in ISB? | GOALisB

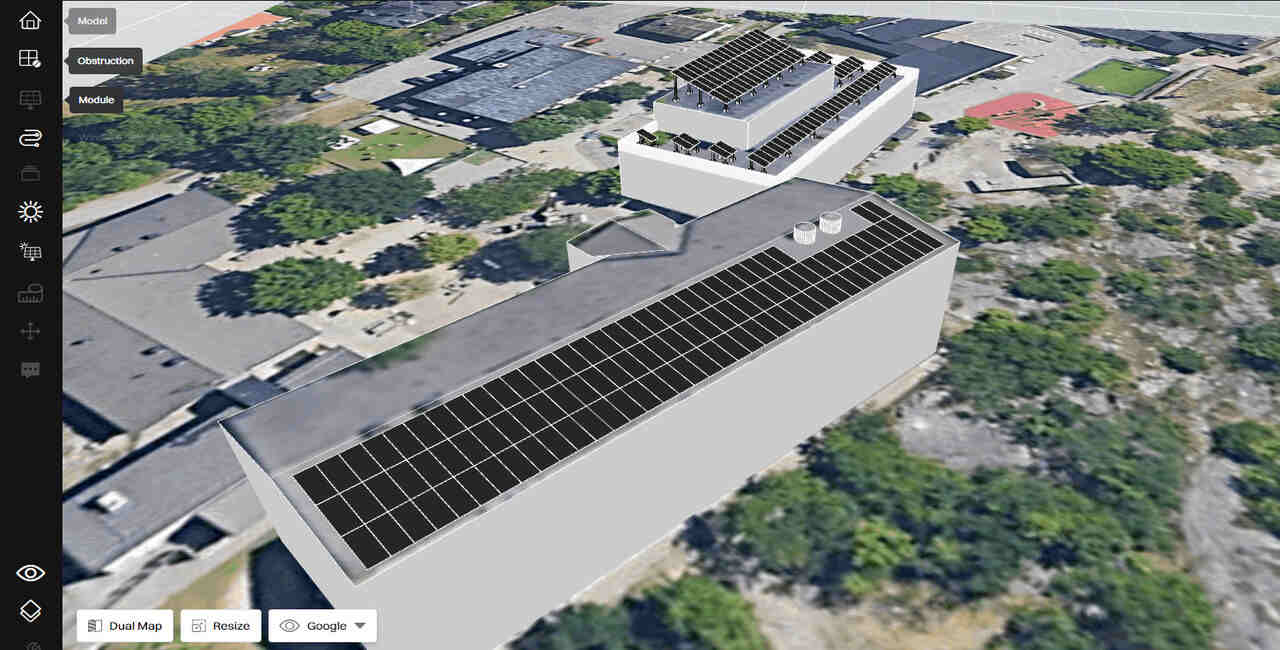

Source : www.goalisb.comBest Solar Design Software [Updated 2025]

Source : arka360.comJonathan Galin KPMG US | LinkedIn

Source : www.linkedin.comLizzy Lozano, Author at UPDF

Source : updf.comSolar Proposal Software Why You Need This In 2025?

Source : arka360.comTaxation Of Individuals And Business Entities 2025 Pdf24 Nick Patras on LinkedIn: Key takeaways from recent CAMT releases: The House passed on Wednesday a $78 billion bipartisan tax package a small business can immediately write off. The cap would then be indexed to inflation, starting after 2025. . As part of its agenda for the ‘UAE Innovates 2025’ initiative, held throughout the month of February, the Federal Tax Authority (FTA) signed a collaboration agreement with the 01GOV Platform, in an .

]]>